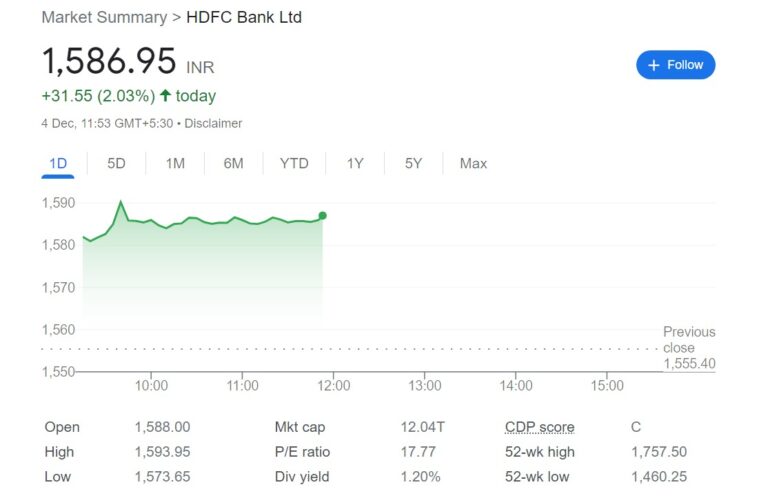

HDFC Bank, India’s largest private sector lender, saw its shares rise by 0.83% on Wednesday, December 1, 2023, to close at Rs 1,555.40 on the National Stock Exchange (NSE). The bank’s share price outperformed the Nifty Bank index, which fell by 0.29% on the same day. The bank’s market capitalization stood at Rs 11.8 trillion, making it the most valuable bank in the country.

READ

HDFC Bank share price was boosted by its strong quarterly results for the second quarter of fiscal year 2024, which ended on September 30, 2023. The bank reported a 51.11% year-on-year increase in its net profit to Rs 168.11 billion, beating analysts’ estimates. The bank’s revenue also grew by 132.44% year-on-year to Rs 630.05 billion, driven by robust growth in its net interest income, non-interest income, and other income. The bank’s net interest margin, a key measure of profitability, improved to 4.1% from 3.9% a year ago. The bank’s asset quality also improved, as its gross non-performing assets ratio declined to 1.08% from 1.37% a year ago.

The bank also announced a dividend of Rs 5 per share for the second quarter, which will be paid on December 15, 2023, to the shareholders on record as of December 8, 2023. The dividend payout ratio, which indicates the percentage of earnings distributed as dividends, was 23.79%, which is in line with the bank’s policy of maintaining a payout ratio of 20-25%.

The bank’s share price has gained 6.27% in the past month, outperforming the Nifty Bank index, which has gained 4.88% in the same period. The bank’s share price has also outperformed the broader Nifty 50 index, which has gained 3.74% in the past month. The bank’s share price has been supported by its consistent growth, strong fundamentals, and diversified business model. The bank has a dominant position in the retail banking segment, with a market share of 26.6% in retail loans and 28.3% in retail deposits as of September 30, 2023. The bank also has a strong presence in the corporate banking, treasury, and wholesale banking segments, which provide a balanced revenue mix.

The bank’s share price has a consensus target price of Rs 1,714.65, which implies a potential upside of 10.25% from the current level. The bank has received 39 analyst ratings, of which 32 are buy, four are outperform, three are hold, and none are underperform or sell. The bank’s share price has a 52-week high of Rs 1,757.50 and a 52-week low of Rs 1,460.25.