Insurance Funnel refers to the process of guiding potential insurance customers through a series of steps toward purchasing an insurance product or service.

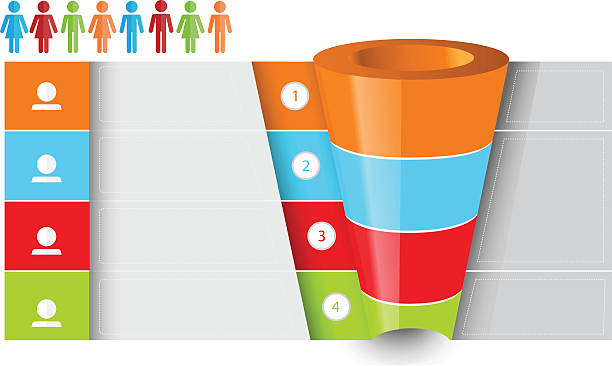

The funnel represents a metaphorical journey that a potential customer goes through, from initial awareness and consideration to making a purchase decision. The steps in the funnel may include lead generation, lead nurturing, customer engagement, and ultimately conversion.

The insurance funnel can be optimized through various strategies, such as targeted marketing campaigns, personalized communication, and simplifying the customer journey to improve the overall experience. The goal of the insurance funnel is to improve customer acquisition, retention, and satisfaction.

Understanding the customer journey is crucial for the success of an insurance sales funnel. By mapping out the journey, insurance providers can gain insights into their customers’ needs, motivations, pain points, and decision-making processes. This understanding can help insurers create a more personalized and effective sales strategy, and improve the overall customer experience.

- Awareness: At this stage, customers become aware of the need for insurance, either through personal experience or external factors like life events or news. The goal is to capture the customer’s attention and introduce the insurance brand.

- Consideration: Customers start to research insurance options and compare different providers. The goal is to provide helpful information and resources to position the insurance provider as a reliable and trustworthy option.

- Evaluation: Customers narrow down their options and evaluate the benefits and costs of each one. The goal is to provide tailored solutions that meet the customer’s specific needs and budget.

- Purchase: Customers make a final decision and purchase insurance. The goal is to ensure a smooth and straightforward purchase process.

- Post-purchase: Customers engage with the insurance provider for ongoing support, claims, and renewals. The goal is to provide excellent customer service and retain the customer for future business.

Top-of-Funnel

Top-of-funnel strategies are designed to attract potential customers and generate leads for the insurance provider. Here are some effective strategies for lead generation:

Content Marketing

Creating valuable content like blog posts, infographics, videos, and ebooks can attract potential customers to the insurance provider’s website. By offering helpful information, insurance providers can establish themselves as industry experts and gain the trust of potential customers.

Search Engine Optimization (SEO)

Optimizing the insurance provider’s website and content for search engines can improve the chances of being found by potential customers. By targeting relevant keywords and optimizing meta tags, headers, and descriptions, insurers can increase their visibility in search results.

Social Media Marketing

Using social media platforms like Facebook, LinkedIn, and Twitter to share content, engage with potential customers, and promote the insurance brand can increase awareness and attract leads.

Paid Advertising

Pay-per-click (PPC) advertising on search engines and social media platforms can help insurers reach a larger audience and attract potential customers who are actively searching for insurance products or services.

Referral Programs

Encouraging existing customers to refer their friends and family to the insurance provider can be an effective way to generate leads. Offering incentives like discounts or rewards can motivate customers to refer others to the insurer.

Middle-of-Funnel

Middle-of-funnel strategies are focused on building relationships with potential customers and nurturing leads that have already shown interest in the insurance provider. Here are some effective strategies for lead nurturing:

- Email Marketing: Sending personalized and targeted emails to potential customers can help insurers stay on top of their minds and provide valuable information that moves them closer to a purchase decision.

- Remarketing: Using targeted ads to remind potential customers about the insurance provider after they’ve visited the website or interacted with the brand can help keep them engaged and interested.

- Webinars and Events: Hosting educational webinars or in-person events can provide potential customers with valuable information and establish the insurance provider as an industry expert.

- Personalization: Providing personalized recommendations and solutions based on the potential customer’s needs and preferences can improve engagement and build trust.

- Lead Scoring: Scoring leads based on their level of engagement and interest can help insurance providers prioritize their efforts and focus on the most promising leads.

Bottom-of-Funnel

Bottom-of-funnel strategies are focused on engaging with potential customers who are close to making a purchase decision and converting them into paying customers. Here are some effective strategies for customer engagement:

- Live Chat and Phone Support: Providing instant and personalized support through live chat or phone can help potential customers get their questions answered quickly and overcome any concerns they may have about making a purchase.

- Free Trials and Demos: Offering free trials or demos of insurance products or services can give potential customers a chance to experience the benefits and value firsthand.

- Case Studies and Testimonials: Providing case studies and testimonials from satisfied customers can help potential customers understand the value and benefits of the insurance provider’s products or services.

- Upselling and Cross-Selling: Offering complementary or upgraded insurance products or services can increase the value of the purchase and improve customer satisfaction.

- Abandoned Cart Follow-up: Sending personalized and targeted follow-up emails to potential customers who have abandoned their cart can help bring them back and close the sale.

Conversion Strategies for Closing Deals

Conversion strategies are focused on closing deals and converting potential customers into paying customers. Here are some effective strategies for conversion:

- Clear and Simple Purchase Process: Making the purchase process as simple as possible can help reduce friction and improve the chances of conversion.

- Competitive Pricing and Discounts: Offering competitive pricing and discounts can incentivize potential customers to make a purchase and increase the perceived value of insurance products or services.

- Social Proof and Trust Signals: Providing social proof and trust signals like customer reviews, certifications, and security badges can help build trust and reduce any concerns potential customers may have about making a purchase.

- Urgency and Scarcity: Creating a sense of urgency and scarcity through limited-time offers, countdown timers, and limited availability can incentivize potential customers to act quickly and make a purchase.

- Post-Purchase Follow-up and Support: Providing post-purchase follow-up and support can help improve customer satisfaction and loyalty, and increase the chances of repeat business and referrals.

Tools and Technologies for Optimizing the Insurance Funnel

There are several tools and technologies that insurance providers can use to optimize their funnel and improve the efficiency and effectiveness of their sales and marketing efforts. Here are some examples:

- Customer Relationship Management (CRM) Software: CRM software can help insurance providers manage customer interactions and data throughout the entire funnel, from lead generation to conversion and retention.

- Marketing Automation Software: Marketing automation software can help insurance providers automate and optimize their marketing campaigns, from email marketing to social media advertising.

- Analytics and Reporting Tools: Analytics and reporting tools can provide valuable insights into customer behavior and engagement, and help insurance providers track and measure the success of their sales and marketing efforts.

- Chatbots and AI-Powered Assistants: Chatbots and AI-powered assistants can help insurance providers provide instant and personalized support to potential customers and improve the efficiency of their customer service operations.

- Digital Document Management Platforms: Digital document management platforms can help insurance providers streamline and automate their document workflows, from policy creation to claims processing.

Metrics and Analytics for Measuring Funnel Performance

Measuring funnel performance is critical for identifying areas of improvement and optimizing the sales and marketing process. Here are some key metrics and analytics that insurance providers can use to measure their funnel performance:

- Conversion Rates: Conversion rates measure the percentage of potential customers that convert to paying customers at each stage of the funnel.

- Lead Velocity Rate: Lead velocity rate measures the speed at which leads are moving through the funnel and provides insight into the efficiency of the sales and marketing process.

- Customer Acquisition Cost (CAC): Customer acquisition cost measures the cost of acquiring a new customer and provides insight into the efficiency of the sales and marketing process.

- Customer Lifetime Value (CLV): Customer lifetime value measures the total revenue a customer generates throughout their relationship with the insurance provider and provides insight into the long-term profitability of the customer.

- Return on Investment (ROI): Return on investment measures the financial return on the investment in sales and marketing efforts and provides insight into the effectiveness of the sales and marketing process.

Best Practices for a Successful Insurance Funnel

Here are some best practices for insurance providers to follow to build a successful insurance funnel:

- Clearly Define Your Target Customer: Clearly define your target customer persona based on demographics, interests, and behavior patterns. This will help you tailor your sales and marketing efforts to meet the needs of your ideal customer.

- Create Valuable Content: Create valuable content that educates and informs potential customers about insurance products and services. This will help establish your brand as an authority in the industry and build trust with potential customers.

- Use Multiple Channels: Use multiple channels, including social media, email, and paid advertising, to reach potential customers and move them through the funnel.

- Leverage Technology: Leverage technology, such as CRM software, marketing automation tools, and analytics platforms, to streamline and optimize the sales and marketing process.

- Provide Excellent Customer Service: Provide excellent customer service throughout the entire funnel, from lead generation to retention, to ensure customer satisfaction and loyalty.

- Continuously Measure and Optimize: Continuously measure and optimize your funnel performance using metrics and analytics, and make changes as needed to improve efficiency and effectiveness.

In conclusion, building a successful insurance funnel is critical for insurance providers to effectively reach potential customers, move them through the sales process, and ultimately convert them into paying customers. By understanding the customer journey, implementing top-of-funnel lead generation strategies, middle-of-funnel lead nurturing strategies, bottom-of-funnel customer engagement strategies, and conversion strategies for closing deals, insurance providers can build a funnel that maximizes their sales and marketing performance. By leveraging technology, providing excellent customer service, and continuously measuring and optimizing their funnel performance, insurance providers can create a streamlined and effective sales and marketing process that drives revenue growth, improves customer satisfaction and loyalty, and positions the brand for long-term success.

Trupanion Affiliate Program: Earn by Referring Pet Insurance Policies

Frequently Asked Questions

Why is an insurance funnel important?

An insurance funnel is important because it helps insurance providers effectively reach potential customers, educate them about their products and services, build trust and loyalty, and ultimately convert them into paying customers.

- Identify your audience

- Capture their attention

- Develop a landing page

- Nurture the prospect

- Close the sale and keep in touch.

- Awareness

- Interest

- Desire

- Action

- Loyalty

What is dual funnel system insurance?

A dual funnel system in insurance refers to a sales and marketing approach that utilizes two separate but complementary funnels: one for acquiring new customers and one for retaining existing customers.