Target Cash Back Policy – Target is a retail company based in the United States. It was founded in 1902 and is currently one of the largest retailers in the country. Target operates over 1,900 stores in the United States and has a significant online presence.

The company sells a wide range of products, including clothing, electronics, home goods, groceries, and more. Target is known for its affordable prices, trendy merchandise, and commitment to corporate social responsibility, including sustainability initiatives and community outreach programs.

READ ALSO

What is Target Cash Back?’

Target Cash Back is a service offered to customers who make purchases with a debit card at Target stores. When making a purchase with a debit card, you have the option to request cash back at the time of checkout, up to the limit allowed by the store and your card’s daily withdrawal limit.

The amount of cashback you can receive varies depending on the store’s cash availability but typically ranges from $20 to $40 per transaction. Cashback is a convenient way to obtain cash without having to visit an ATM or bank, and it can be helpful when you need small amounts of cash for everyday expenses. It’s important to note that cashback is not available for purchases made with a credit card.

How to Get Cash Back at Target

Getting cash back at Target is a simple process. Here are the steps to follow:

- Make a purchase: You can get cash back only when you make a purchase at a Target store.

- Choose a debit card: To get cash back, you must use a debit card with a Visa or Mastercard logo. Target does not offer cash back for purchases made with a credit card.

- Select “Debit” and enter your PIN: When you pay for your purchase, choose the “Debit” option and enter your debit card’s Personal Identification Number (PIN) on the keypad.

- Request cash back: After you enter your PIN, the payment terminal will ask you if you want to get cashback. Choose the amount you want to receive, up to the limit allowed by the store and your card’s daily withdrawal limit.

- Collect your cash: Once you complete your transaction, the cashier will give you your receipt and the cash you requested.

Target Cash Back Limits

Target sets limits on the amount of cashback that customers can receive per transaction. The cashback limit at Target is typically between $20 and $40 per transaction, but it can vary depending on the store’s cash availability and the customer’s debit card issuer’s daily withdrawal limit.

It’s important to note that Target sets a maximum amount for cash back per transaction, not per day. This means that you can get cash back multiple times in one day, as long as you don’t exceed the cashback limit for each individual transaction. Additionally, cashback is available only for purchases made with a debit card, not with a credit card.

To find out the specific cash-back limit at your local Target store, you can check with a cashier or consult Target’s website. The limit may vary by location, so it’s always a good idea to confirm before making a purchase if you plan to request cash back.

Pros and Cons of Target Cash Back

Target Cash Back has its pros and cons. Here are some to consider:

Pros:

- Convenience: With Target Cash Back, you can obtain cash without having to visit an ATM or bank.

- No Fees: Target does not charge any fees for cash-back transactions, so you can avoid ATM or bank fees.

- Quick and Easy: Requesting cash back at Target is a quick and easy process, and you can get your cash immediately after your purchase.

- Can help to budget: Getting cash back at Target can be a useful budgeting tool by limiting the amount of cash you carry on you and helping you stick to a budget.

Cons:

- Cash Availability: The amount of cash back you can receive is subject to availability, so you may not always be able to get the full amount you request.

- Limitations: The cash-back limit at Target is typically between $20 and $40 per transaction, so it may not be enough if you need a larger amount of cash.

- Card Restrictions: Target Cash Back is only available for purchases made with a debit card, not with a credit card.

- Security risks: Carrying cash on you can pose security risks, such as theft or loss.

- Inconvenient for those not near a Target store: If you don’t live near a Target store, getting cashback may not be convenient for you.

Target Cash Back vs. Other Stores

Target Cash Back is just one of several cash-back options available to consumers. Here are some comparisons between Target Cash Back and other popular stores:

- Walmart Cash Back: Walmart offers cashback of up to $100 per transaction with a debit card. However, Walmart charges a $3 fee for cash-back transactions, and the amount of cash available for cashback may be limited based on the store’s cash availability.

- CVS Cash Back: CVS offers cashback of up to $35 per transaction with a debit card. Like Target, CVS does not charge any fees for cash-back transactions.

- Walgreens Cash Back: Walgreens offers cashback of up to $20 per transaction with a debit card. Walgreens does not charge any fees for cash-back transactions.

- Costco Cash Back: Costco offers cashback of up to $60 per transaction with a debit card. However, cashback is available only for purchases made with a Costco membership card.

Target RedCard and Cash Back

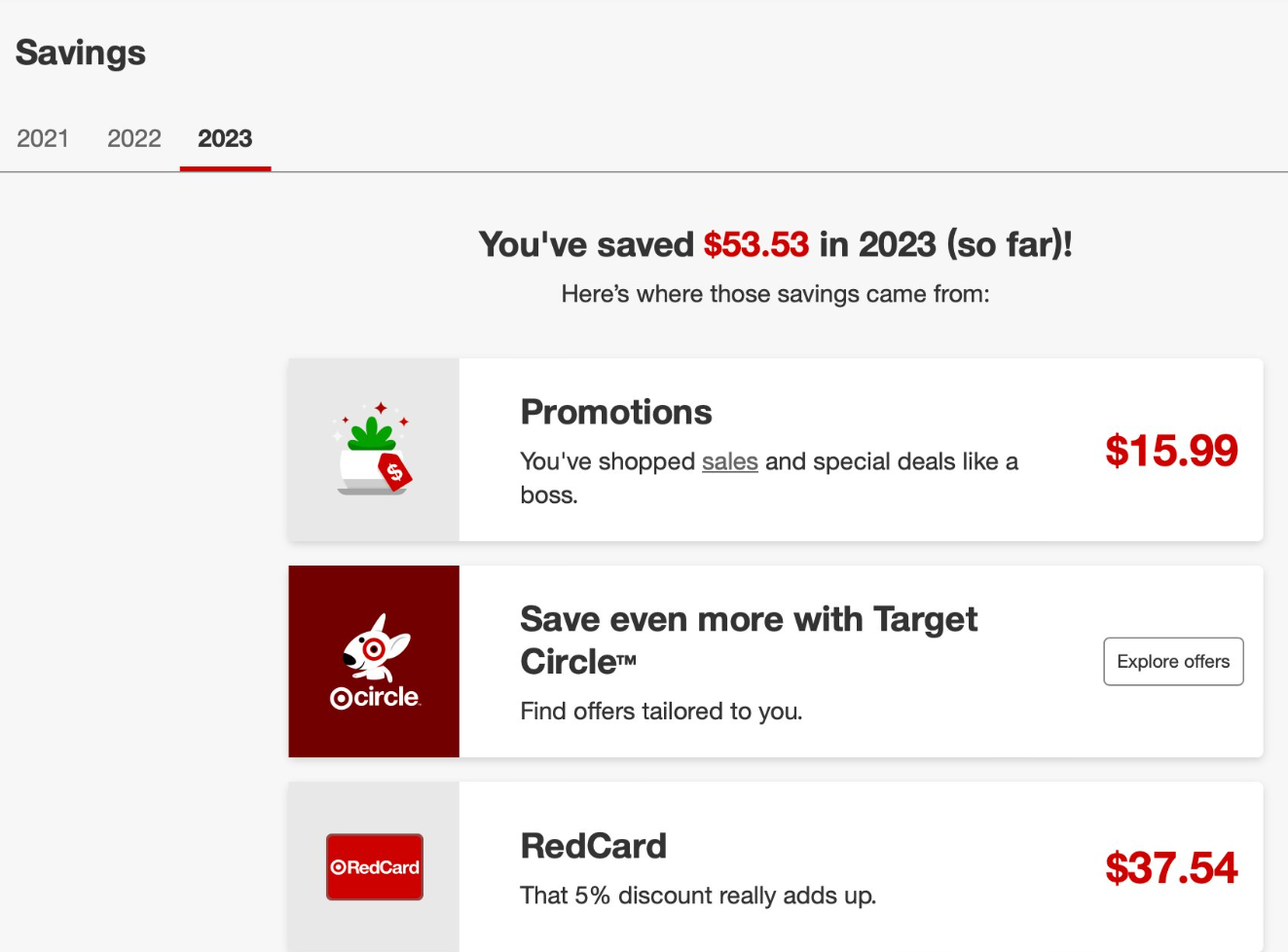

Target RedCard is a credit or debit card offered by Target that provides various benefits, including cash back. Here’s what you need to know about Target RedCard and cashback:

- Cashback on purchases: With the Target RedCard, you can earn 5% cash back on purchases made at Target stores and on Target.com. This cashback is applied automatically as a discount on your purchase.

- No additional cash back on cashback transactions: If you use your Target RedCard to request cash back at the register, you will not receive any additional cash back beyond the 5% cash back on your purchase.

- Cash withdrawal limit: The cash withdrawal limit with the Target RedCard varies depending on the type of card you have. The debit card version of the Target RedCard allows you to withdraw up to $40 in cash per transaction, while the credit card version does not offer cash withdrawals.

- Credit score impact: Applying for and using the Target RedCard may impact your credit score. If you are concerned about your credit score, you should review your credit report and credit score before applying for a new credit card.

Tips for Using Target Cash Back Wisely

If you’re planning to use Target Cash Back, here are some tips to help you use it wisely:

- Plan ahead: Before you go to Target, make a list of what you need to purchase and how much cash you’ll need. This will help you avoid unnecessary cashback transactions and keep your spending in check.

- Be mindful of the cashback limit: The cashback limit at Target is typically between $20 and $40 per transaction. If you need more cash than the limit, consider making multiple purchases or using a different cash-back option.

- Avoid impulse purchases: Just because you have the option to get cash back at Target doesn’t mean you should make impulse purchases. Stick to your list and budget to avoid overspending.

- Keep track of your cash: If you do get cash back at Target, be sure to keep track of how much you have and where you spend it. This will help you avoid losing track of your cash and overspending.

- Consider other cashback options: While Target Cash Back can be a convenient option, it’s important to consider other cashback options and compare fees, limits, and availability to ensure you’re getting the best deal.

- Use a secure payment method: When requesting cash back, use a secure payment method like a debit card. This will help protect you from fraud and ensure that your personal information is kept safe.

In conclusion, Target Cash Back is a convenient service that allows customers to get cash back when making a purchase with a debit card at Target stores. While there are some limitations to the amount of cash back you can get and the payment methods accepted, using this service can be a helpful way to avoid ATM fees and get cash when you need it. However, it’s important to use Target Cash Back wisely by planning ahead, avoiding impulse purchases, and keeping track of your cash. By following these tips and understanding the limitations and advantages of Target Cash Back, you can make the most of this service and avoid potential issues.

Frequently Asked Questions F&Qs

target cashback minimum

Target stores have a minimum cashback amount of $0.01. This means that you can request cash back for any amount above one cent, as long as it doesn’t exceed the cashback limit set by the store.

stores with the highest cash-back limit

Some stores that may have higher cash-back limits include Walmart, Kroger, and Safeway. These stores typically offer cash-back limits of $100 or more per transaction.

does target do cash back at self-checkout?

Yes, Target does offer cash back at self-checkout registers, as long as the payment method used is a debit card. To request cash back at a self-checkout register, simply select the cash back option on the payment screen and follow the prompts to complete your transaction.

does target do cash back with apple pay?

No, Target does not offer cashback with Apple Pay.

does target give cash back on debit card returns?

Yes, Target will generally provide cash back on debit card returns, as long as the original purchase was made using a debit card and the amount being refunded is less than or equal to the original purchase amount.

does target do cash back on credit cards?

No, Target does not offer cash back on credit cards. Cashback is only available for debit card transactions at Target stores.

target red card cash back limit

The Target RedCard cash back limit is not explicitly stated by Target, but it is generally understood to be $40 per transaction.